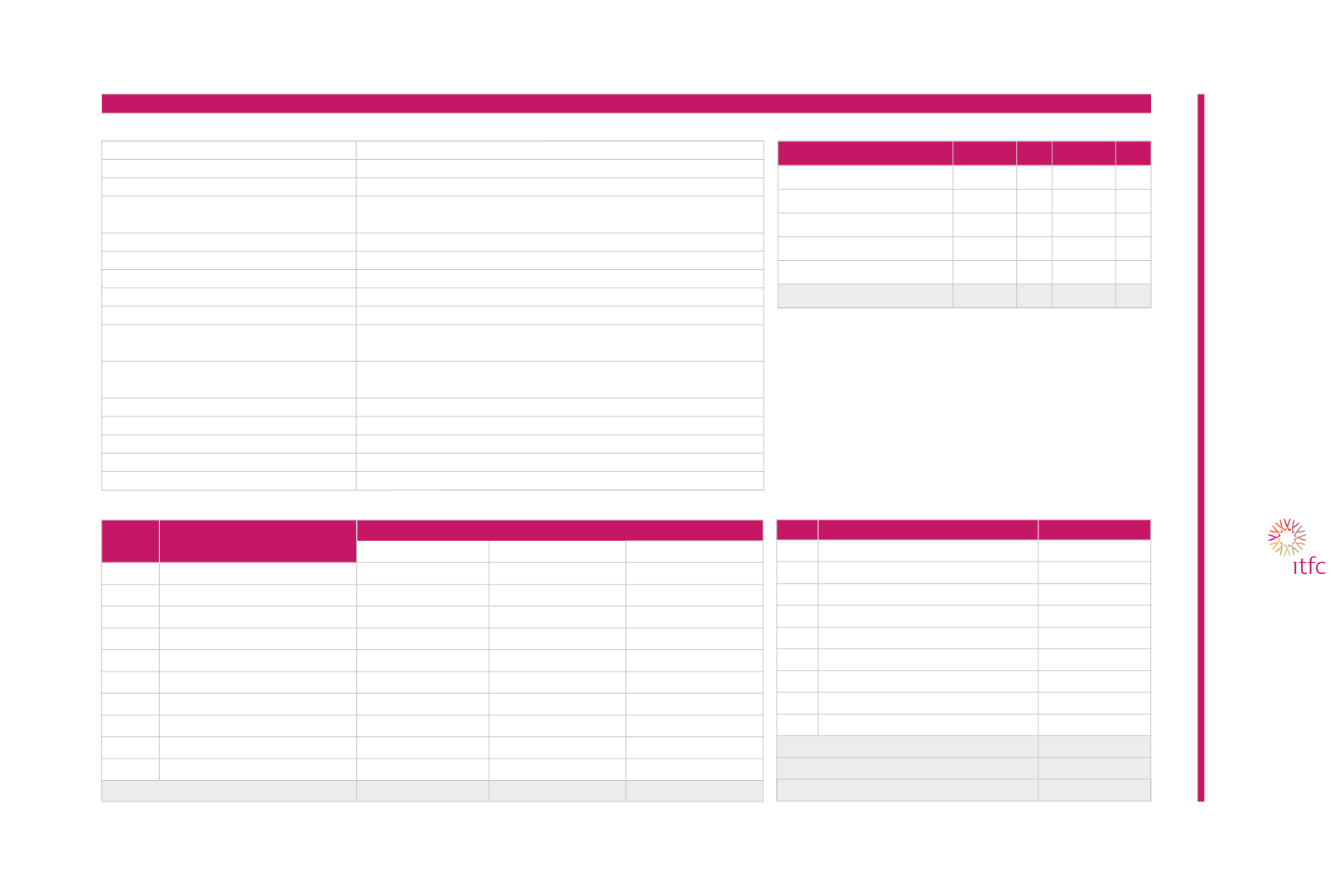

ITFCTrade Approvals byType of Security (US$ Mil.)

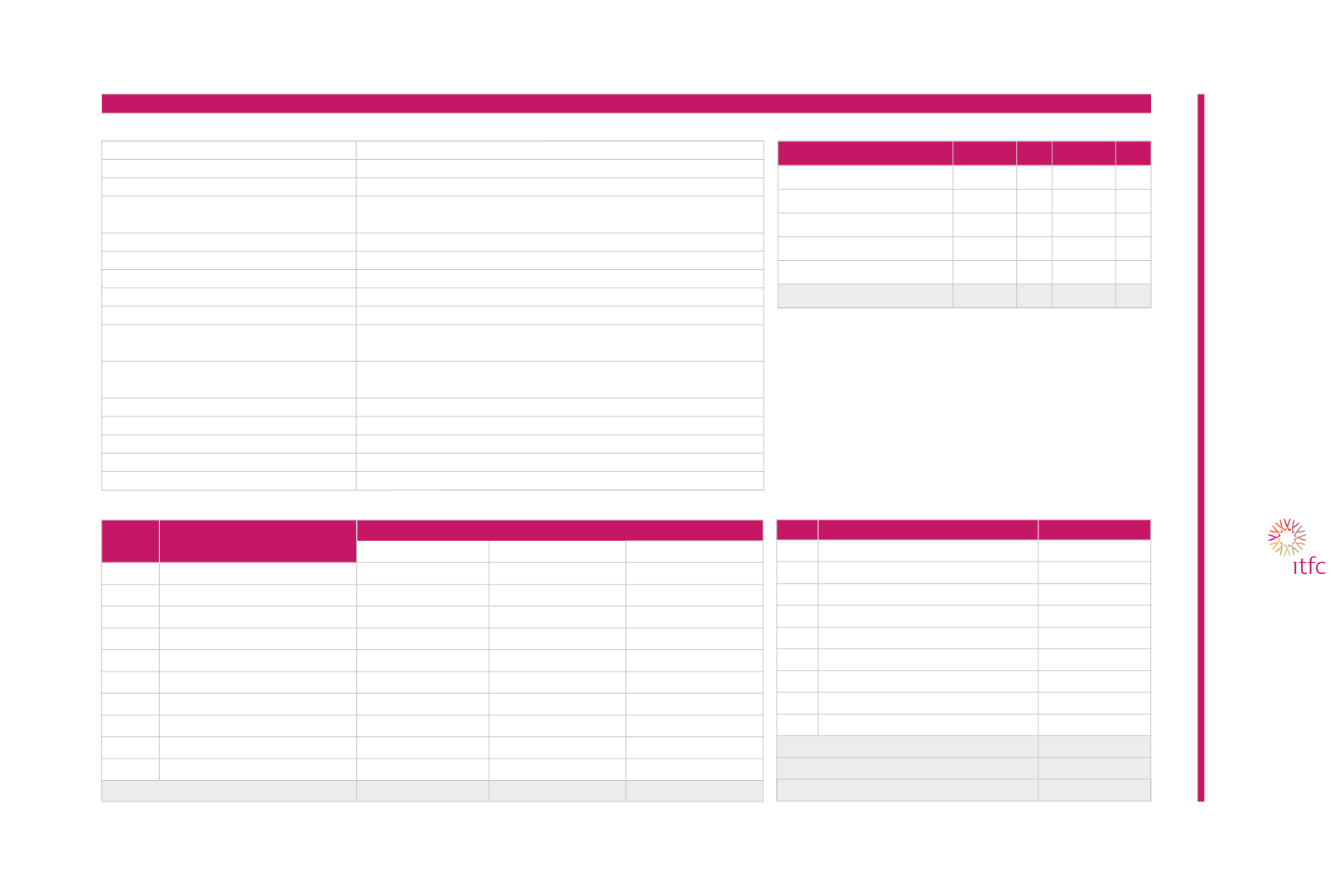

2019Trade Finance Approvals by Commodity

2019Trade Finance Approvals for LDMCs

815.00

393.00

111.00

210.00

55.00

72.00

105.00

278.00

62.00

2,101.00

5,841.00

35.9%

Country

S. No.

2019

Total for LDMCs

Total Approvals

%

Bangladesh

Burkina Faso

Comoros

Djibouti

Gambia

Mali

Mauritania

Senegal

Togo

1

2

3

4

5

6

7

8

9

Total

Commodity

2019

No.

1

2

3

4

5

6

7

8

9

10

No. of Operations

Percentage (%)

Grains & Oilseeds

Cotton

Sugar

Other Foodstuff

Petroleum

Pharmaceuticals

Other Chemicals

Metals

Machinery & Equipment

Other

Amount (US$ Mil.)

2

2

1

10

47

1

1

1

3

16

84

1.18%

3.80%

0.17%

4.52%

76.17%

0.43%

0.68%

0.34%

0.94%

11.76%

100%

69.00

222.00

10.00

264.00

4,449.00

25.00

40.00

20.00

55.00

687.00

5,841.00

Financial and Operational Highlights - 2019 (FACT SHEET)

Commenced Operations

Headquarter

Member

Mandate

Authorized Capital

Subscribed Capital

Paid- Up Capital

Approved Trade Finance Operations

Disbursements

Approvals by Sector

Approvals by Region

Private Sector Support

Intra-OIC Trade Support

Number of Member Countries Served

Number of Operations

LDMCs Portfolio Share

January 10, 2008

Jeddah, Saudi Arabia

The Islamic Development Bank Group

Contribute to economic development of Member Countries

through trade advancement

US$3 billion

US$857.19 million

US$749.788 million

US$5,841 million

US$4,977 million

Energy-US$4,449 million; Food & Agriculture-US$565 million;

Financial-US$677 million; Others-US$150 million

Asia & Middle East-US$3,809 million;

Africa-US$2,032 million

US$821 million

US$3,934.5 million

26

84

36%

Type of Security

2018 Actual

% 2019 Actual

%

4,362.8

635.8

92.0

30.0

80.0

5,200

83.9

12.2

1.8

0.6

1.5

100

86.0

2.0

10.0

-

2.0

100

5,019

117

601

-

104

5,841

Sovereign

Bank Guaranteed

Unsecured Lending

STF

Credit Insurance

Total

ITFC KEY FINANCIAL HIGHLIGHTS