$14.6 BILLION

IN EXPORT CREDIT AND INVESTMENT INSURANCE

COMMITMENTS SINCE 1415H (1995) TILL 1433H (2012)

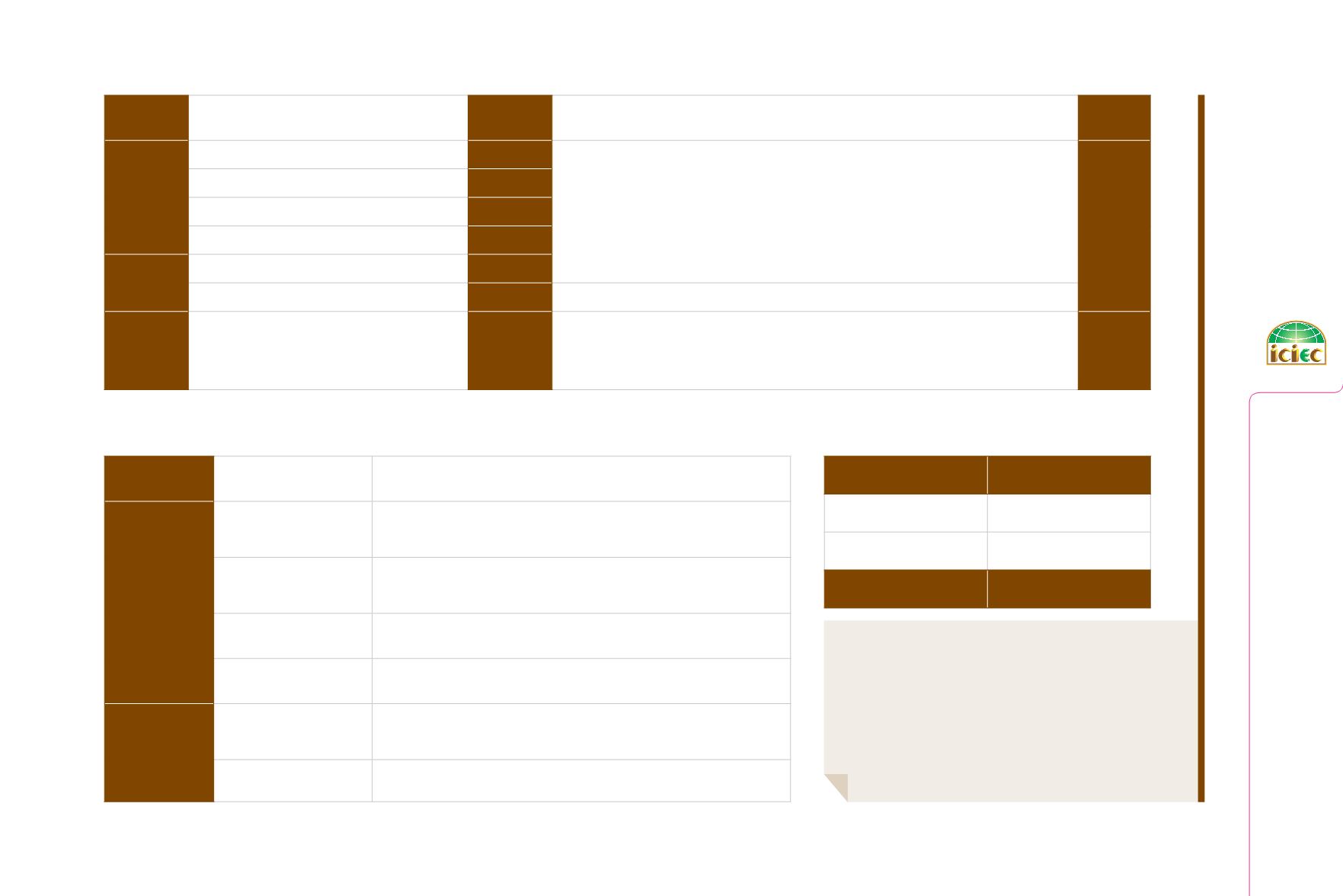

Segment

Instrument / Product

Maximum

Term

Purpose

Risks

Covered

Exporters

Comprehensive Short Term Policy (CSTP)

2 years

To protect Exporters and Banks against the risk of non-payment of an export receivable.

Non payment due

to Commercial and

Country Risks

Globalliance Policy

1 year

Contract Frustration Policy

7 years

Specific Transaction Policy (STP)

7 years

Banks

Bank Master Policy (BMP)

7 years

Documentary Credit Insurance Policy (DCIP)

2 years

To protect the confirming bank of a Letter of Credit against the risk of non-payment by the issuing bank.

Investors

Financiers

»

»

Equity Investment Policy

»

»

Financing Facility Policy

»

»

Loan Guarantee Policy

»

»

Non Honoring of Sovereign Obligations

Up to

15 years

To protect investors and financiers against country risks.

Country

Risks

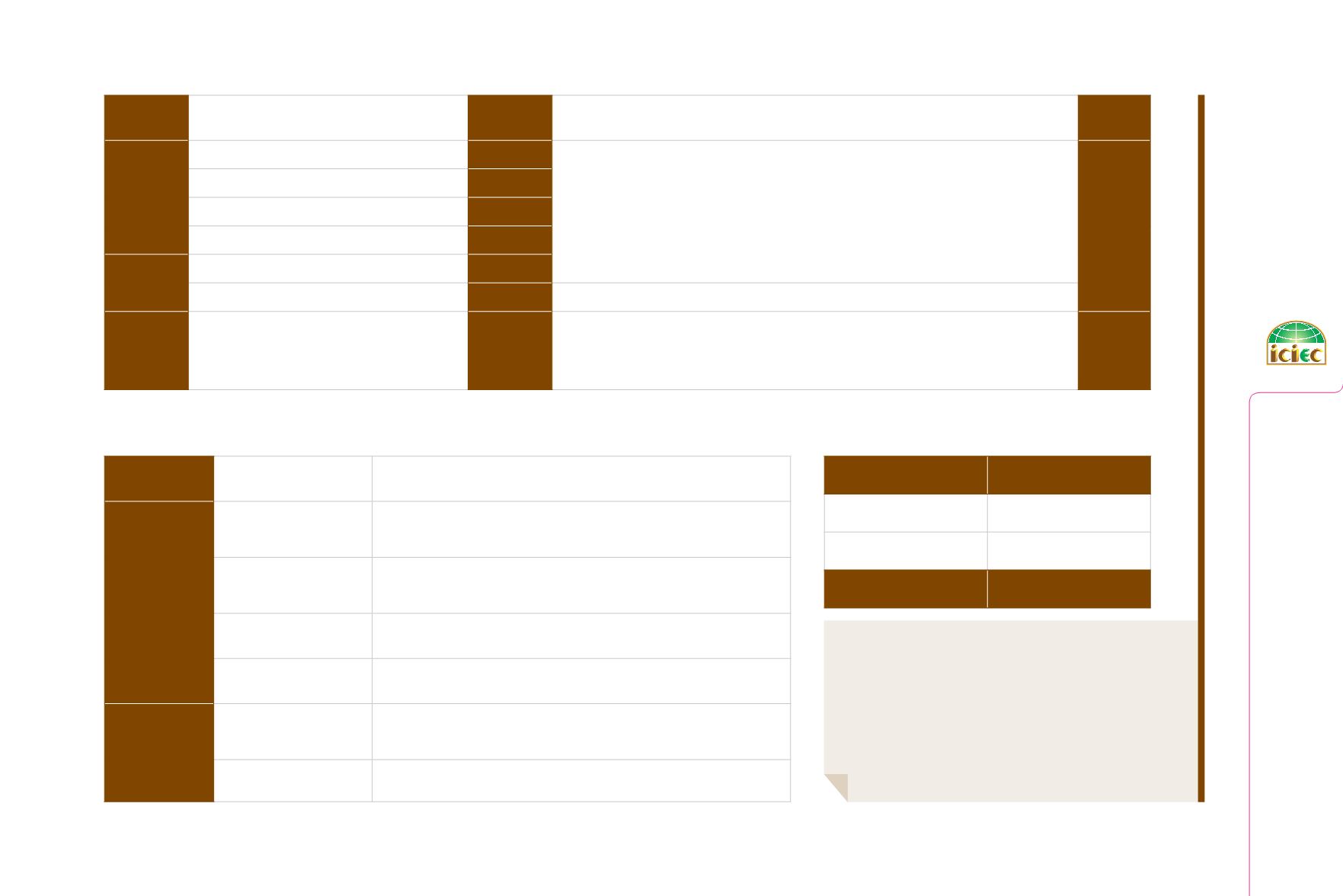

Types of

Reinsurance

Reinsurance

Arrangement

Purpose

Inward

Reinsurance

Fronting

Arises when an ECA has issues concerning issuance of a policy due to legislation, risk and

capability reasons. ICIEC as a multilateral institution can assist to overcome such restric-

tion.

Quota Share Treaty

Agreement between ECA and ICIEC whereby ICIEC agrees to be the reinsurer to the ECA

concerned. It contains provisions defining the terms of the agreement including specific

risk definition, data on limits, retention, provisions for premium payment, duration etc.

Reinsurance Facility

Agreement (RFA)

Offered to ECAs in Member countries to reinsure, on facultative basis, the commercial and/or

political risks underwritten by the ECAs.

Excess of Loss Reinsur-

ance Treaty

Subject to a specified limit, indemnifies the ceding company (ECA) for the amount of loss

in excess of a specified retention.

Outward

Reinsurance

Quota Share Treaty

Agreement between ICIEC and ‘A’ rated Reinsurers in the market who agree to be ICIEC's

reinsurers for a specified period and on agreed terms and conditions. Currently our Treaty

reinsurers are Atradius Re and Catlin, in London.

Facultative Reinsurance

It provides ICIEC with coverage for specific individual risk that is unusual and so large that is not

covered in ICIEC Quota Share ReinsuranceTreaty.

Key Indicators since inception up to the end of 1433H (2011-2012)

Business Insured

USD 14.67 billion

»

»

Export Credit

USD 12.70 billion

»

»

Investment

USD 1.97 billion

Claims Paid

USD 24.44 million