ACTIVITIES OF THE GROUP

»

»

Project financing in public and private sectors

»

»

Development assistance for poverty alleviation

»

»

Technical assistance for capacity building

»

»

Economic cooperation among member countries

»

»

Trade financing

»

»

SME financing

»

»

Resource mobilization

»

»

Direct equity investment in Islamic financing institutions

»

»

Insurance and reinsurance coverage for investment and export credit

»

»

Research and training programmes in Islamic economics and banking

»

»

Awqaf investment and financing

»

»

Special assistance and Scholarships for member countries and Muslim

communities in non-member countries

»

»

Emergency relief; and

»

»

Advisory services for public and private entities in member countries.

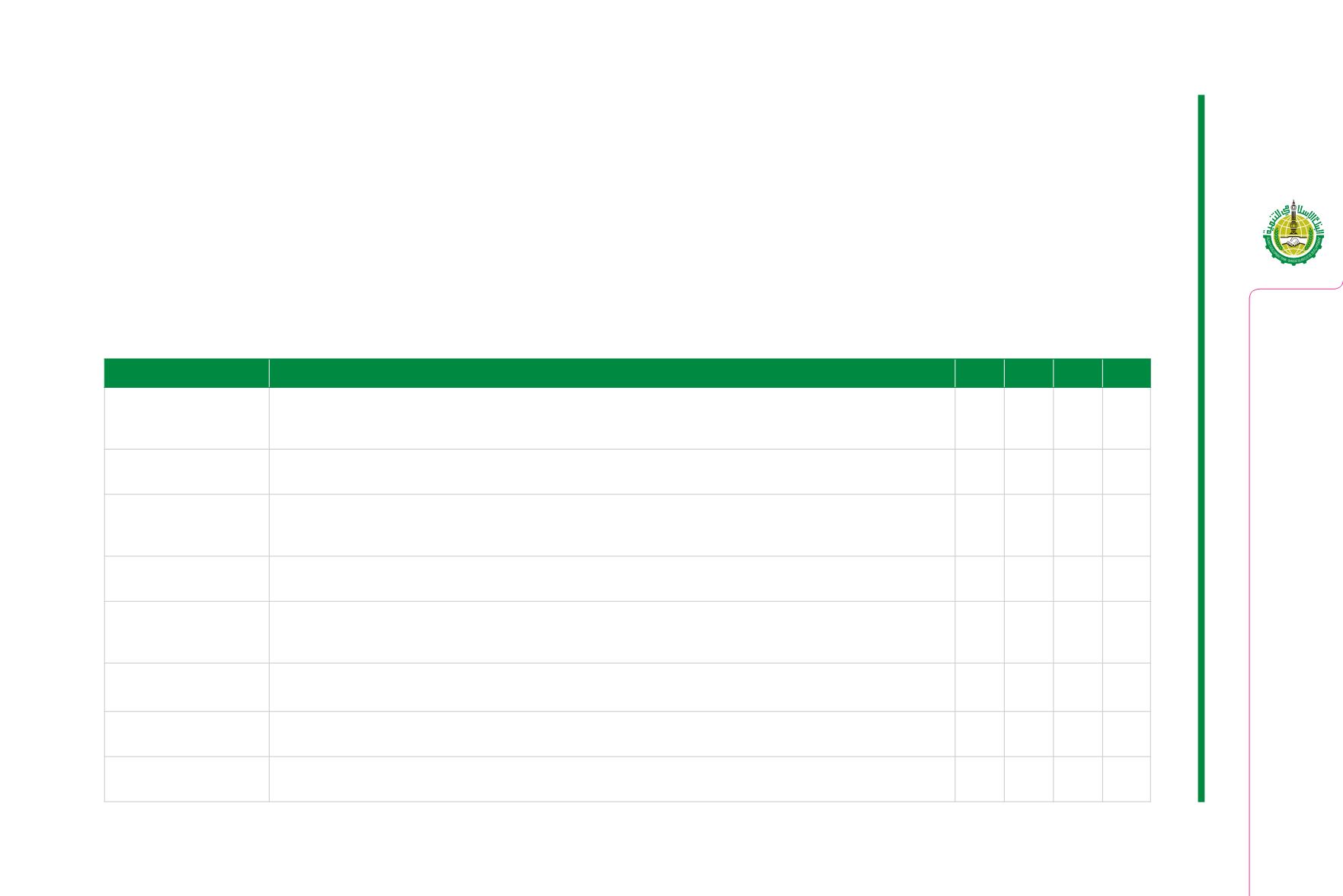

Mode of Finance

Description

PPP ICD ITFC IFSD

Mushraka (Equity

Participation)

This isconsideredthepurestformsof IslamicFinancing,wherethe investorssharebothrisksandbenefitsoftheproject.Underthisarrangement,

all parties contribute towards the financing of a venture and they agree to share profits on a pre-agreed ratio, while losses are shared according

to each party’s contribution. Management of the venture is carried out by all, some or just one party.

•

•

•

Diminishing Mushraka

This mode of financing allows equity participation and sharing of profit on a pro rata basis. It also provides a method through which IDB Group

keeps on reducing its equity in the project and ultimately transfers the ownership of the asset to one of the participants.

•

Mudharaba

A form of partnership where on party provides the funds, while the other provides the expertise and management.The former (Capitalist)

is known as the rab-al-maal, while the latter is referred to as the mdaris. Any profits accrued and shared between the two parties on a

pre-agreed basis, while capital loss is borne by the rab-al-maal.

•

Leasing (Ijara)

A mode of financing, which involves purchasing and subsequently transfetting the right of use of capital goods to the benificiary for an

agreed rental fee and duration. During the lease period, IDB Group retains ownership of the asset.

•

•

•

Installment Sale

(Bai Ajel)

A mode of financing under which, IDB Group purchases capital goods and resells them to the benificiary at a price agreed by the two

parties.The ownership of the asset is transferred to the purchaser on delivery and payment of the sale price is made through consecutive

installments.

•

•

•

Manufacturing Contract

Finance (Istisna’a)

A contract under which, IDB Group agrees to manufacture/acquire an asset based on an order and specifications of a buyer (benificiary)

and then sells the asset for an agreed price and method of payment (fixed or variable installments) to the buyer.

•

•

•

Murabaha

A contract of sale between IDB Group and its benficiary for the sale of goods at cost plus an agreed profit margin for the IDB Group.

Payment of the sale price is usually by installments.

•

Bai Salam

A sale contract, where the buyer pays in advance for the goods, which are to be delivered in the future. This type of financing is most

often used when a farmer needs capital to cultivate and harvest his crops.

•

MODE OF FINANCE PROVIDED BY IDB AND ENTITIES